Following the treble winning season in 2012/13, Bayern Munich enjoyed another year of success in 2013/14, once again securing the domestic league and cup double, while reaching the Champions League semi-finals before going down to eventual winners Real Madrid.

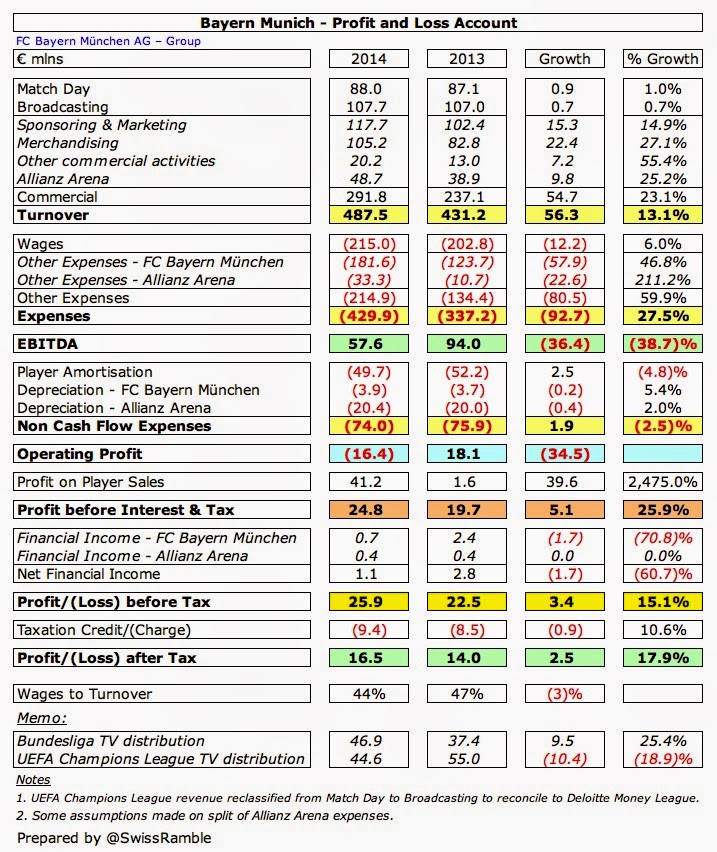

The excellent season on the pitch was matched off it with revenue surging 13% to €487.5 million and profit before tax up to €25.9 million (€16.5 million after tax). Furthermore, all outstanding debt on the club’s Allianz stadium was paid off 15 years early. Little wonder that deputy chairman Jan-Christian Dreesen stated, “FC Bayern can present its members with financial results better than any the club has ever had before.”

Bayern’s profit before tax rose €3 million (15%) from €23 million to €26 million, as the €55 million growth in commercial income and €40 million increase in profits on player sales was largely offset by a €12 million increase in the wage bill and an €80 million rise in other expenses.

Note that these are the consolidated group accounts for FC Bayern München AG, which include the Allianz Arena München Stadion GmbH and all subsidiaries.

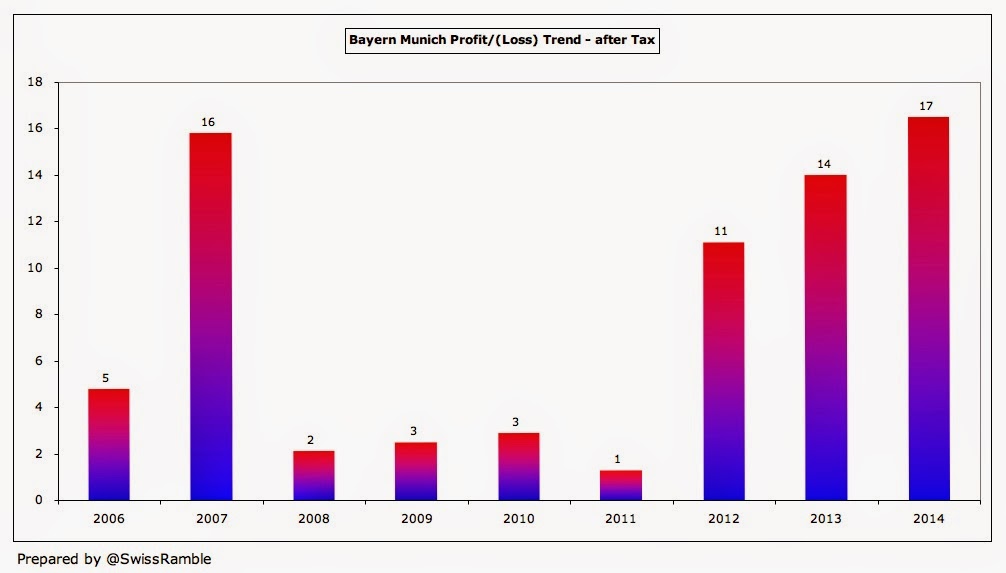

Of course, making money is nothing new to Bayern Munich, as this is the 22nd year in a row that they have been profitable. Traditionally, the club invests almost all of its profits into the squad or stadium development, but their profits have been steadily rising recently, averaging €14 million over the last three years (after tax).

That’s very impressive, though it should be noted that it is not unusual for German clubs to make profits. In fact, 13 out of 18 Bundesliga clubs posted positive figures in the 2013/14 season.

Bayern retained 3rd position in the Deloitte Money League for 2013/14 with €488 million, only behind Real Madrid €550 million and Manchester United €518 million. At this point, we should clarify that Bayern’s reported revenue of €529 million in the club statement also includes €41 million from player transfers, which is excluded for the Money League.

Although they overtook Barcelona €485 million, Bayern were in turn passed by Manchester United, partly due to Sterling strengthening against the Euro (1.1668 to 1.1958 in Deloitte’s calculations), but also because English clubs grew at a faster rate, due to the new Premier League TV deal. On the other hand, Bayern’s 13% revenue growth is much more than the Spanish giants: Real Madrid 6%, Barcelona 0%.

There are only two other German clubs in the Money League (Borussia Dortmund €262 million and Schalke 04 €214 million), but Bayern earn around twice as much as their nearest domestic challengers with €488 million.

Not only is the gap large, but it is getting larger. Since 2007, Bayern has grown its revenue by €265 million, while Dortmund’s growth was €172 million and Schalke €100 million. Bayern’s revenue superiority over the second highest club was €103 million in 2007, but has climbed to €226 million in 2014. Even worse, revenue at clubs like Hamburg, Werder Bremen and Stuttgart has essentially been flat over this period, leading to concern that Bayern’s financial dominance will be bad for competition in Germany.

To further illustrate this point, the revenue disparity between Bayern and Borussia Dortmund has never been higher at €226 million. This is a worthy comparison, despite Dortmund’s current poor form, as their closest challengers won the Bundesliga twice in recent years (2010/11 and 2011/12) and narrowly lost to their Bavarian rivals in an all-German Champions League final in 2012/13. Although the gap off the pitch had closed to “only” €172 million, it is now growing again.

Revenue grew by €56 million (13%) in 2013/14, almost entirely driven by commercial income, which rose €55 million (23%) to a mighty €292 million. Match day and broadcasting revenue each rose by around 1%.

Since 2009, Bayern’s revenue has grown €198 million (68%) from €290 million to €488 million with all three revenue streams showing good growth: commercial up €133 million (83%), broadcasting up €38 million (55%) and match day up €27 million (45%). Most notably, merchandising revenue has almost tripled in that period, rising from €37 million to €105 million.

The growth in commercial income to €292 million means that it now contributes 60% of Bayern’s revenue with broadcasting at 22% (€108 million) and match day 18% (€88 million). Only one other club in the Money League top 20 has commercial income contributing more than 50% of total revenue: that is Paris Saint-Germain, thanks to the French club’s innovative deal with the Qatar Tourism Authority.

Indeed PSG is the only club with higher commercial revenue than Bayern with €328 million, though Bayern are well ahead of clubs like Real Madrid €232 million and Manchester United €226 million. Although commercial deals are very important to all German clubs, Dortmund €124 million and Schalke €104 million earn 2-3 times less than Bayern.

Bayern’s incredible commercial revenue of €292 million is made up of: sponsoring and marketing €118 million, merchandising €105 million, Allianz Arena €49 million and other commercial activities €20 million. Bayern do have the advantage of being the most supported team in the largest commercial market in Europe, but that’s still some going.

They are also boosted by strategic partnerships with three major German companies (Adidas, Allianz and Audi), who all have an 8.33% stake in the club with the other 75% owned by the fans. Adidas has a long-standing relationship with Bayern, recently extending their kit deal for a further eight years until 2020 for a reported €25 million a season. Allianz have also extended their stadium naming rights deal for a further five years to 2041 at around €6 million a season, while Audi is a main sponsor and automotive partner.

In addition, Deutsche Telekom extended their shirt sponsorship deal in 2013/14 for four years, reportedly increasing the annual fee by €5 million to €30 million. Bayern has a raft of other big name sponsors, including Lufthansa, Coca-Cola and Samsung.

The Allianz Arena is another major money-spinner for Bayern. They initially shared ownership with TSV 1860 Munich, but have fully owned the venue since 2006, leasing it back to their former partners since then. Bayern benefits from all other activities staged at the Arena, including concerts and German national team matches.

Perhaps the most staggering figure is from merchandising sales, which rose €22 million (28%) in the last season alone to €105 million. This means that over a fifth of Bayern’s revenue is generated by shirt sales and the like. In fact, Bayern sold 1.3 million replica shirts in 2013/14, which was more than the total sales of all other Bundesliga clubs combined.

Where Bayern (and other German clubs) lose out is in broadcasting revenue, largely due to the Bundesliga TV rights, which lag behind the deals in England, Italy and Spain (at least for the big two). Bayern’s total broadcasting revenue of €108 million is not too bad, but it is only around half of Real Madrid’s €204 million – and is even behind Tottenham Hotspur’s €113 million, even though the North London club did not qualify for the Champions League.

Bayern’s accounts state that they received €47 million from the Bundesliga TV distribution, up €10 million from the previous season. This included €37 million for the TV rights, almost entirely from the domestic deal, plus other money from central partnership deals with the likes of Adidas.

The German TV distribution is based on a points system, whereby points are awarded for finishing places in the Bundesliga over the last five seasons, weighted towards the most recent seasons, e.g. for 2013/14 the points are distributed as follows: 2013/14 factor of 5; 2012/13 factor of 4; 2011/12 factor of 3; 2010/11 factor of 2; 2009/10 factor of 1. The calculated points are then used to determine which place the club has in the distribution table, but the actual distribution is fixed, so that the last placed club receives half of the top place (for the domestic deal) with payments spread evenly for the clubs in between.

To place the Bundesliga TV deal into context, Cardiff City, who finished last in the Premier League in 2013/14, received €74 million TV money, which is significantly more than Bayern’s €47 million.

The good news for German clubs is that the Bundesliga TV rights are increasing and are forecast to almost double in the 10 years from 2006/07, increasing from €424 million to €835 million. In particular, international rights are anticipated to grow from the current €70 million to €154 million in 2015/16 and €162 million in 2016/17, though this will still be significantly lower than the Premier League. It is also worth noting that these TV rights cover the two top German leagues, e.g. in 2013/14 the €560 million domestic deal is split between Bundesliga 1 €448 million and Bundesliga 2 €112 million.

The news is much better for Bayern in Europe, where they received €45 million for reaching the semi-finals in the Champions League, though this represented a €10 million reduction compared to the previous season, when they received €55 million as winners. This has been a lucrative revenue stream for Bayern in recent times, as they have averaged €44 million a season over the last five years – since the disappointing 2007/08 season when they earned less than €5 million for participating in the UEFA Cup.

Despite Germany’s reputation for low ticket prices, Bayern’s match day revenue of €88 million is the fifth largest in the world, as they enjoy average attendances of more than 71,000, though the four clubs ahead of them all generate more than €100 million: Manchester United €129 million, Arsenal €120 million, Barcelona €117 million and Real Madrid €114 million.

In fairness, the Bundesliga only has 18 clubs, so Bayern play two fewer home matches a season compared to the other major leagues. The average revenue per match of €3.5 million is substantially more than any other German team and compares favourably to other Money League clubs.

Bayern’s wage bill rose 6% (€12 million) from €203 million to €215 million in 2013/14, but the wages to turnover ratio fell to a very impressive 44%, the lowest for many years, following the significant revenue growth.

Again, it is interesting to contrast the wages growth with Dortmund. Over the last seven years, the gap has averaged almost exactly €100 million, with Bayern’s €215 million wage bill being twice as much as Dortmund’s €108 million last season.

Using the same exchange rate as Deloitte’s Money League, Bayern have the 6th highest wage bill in world football, a fair way behind Manchester United €257 million, Real Madrid (only football wages, i.e. excluding basketball) €250 million, Barcelona €248 million, Manchester City €245 million and Chelsea €230 million. Only Real Madrid (45%) have a wages to turnover ratio close to Bayern’s 44%.

Traditionally, Bayern Munich have been the big spenders in the German transfer market, often acquiring the strongest players from rivals, e.g. Manuel Neuer from Schalke and Mario Götze and Robert Lewandowski from Dortmund. Since 2002/03 they have splashed out more than half a billion Euros on bringing in players with a net spend of €335 million after player sales.

Even with net sales of €2 million in 2014/15, Bayern still brought in Mehdi Benatia from Roma €28 million, Xabi Alonso from Real Madrid €10 million and Juan Bernat from Valencia €10 million, though this was offset by the sales of Toni Kroos to Real Madrid €30 million and Mario Mandzukic to Atletico Madrid €22 million.

Despite this flat 2014/15 expenditure, Bayern’s net spend of €135 million over the last four years is still miles higher than other German teams. In the same period, all other Bundesliga clubs only spent a net €172 million. Basically, Bayern’s motto has been, “If you’ve got it, flaunt it.”

Although the football club has had no debt for a while, the group did have debt from the Allianz Arena company, which was used to finance the €346 million needed to build the stadium. This loan was taken out in 2005 with the original intention to pay it off over 25 years, i.e. by 2030, but the club have announced that they have actually already paid it off, more than 15 years ahead of schedule.

This has largely been thanks to equity injections from the club’s strategic partners, including €110 million most recently from Allianz, but it is still a notable achievement. Importantly, now that the stadium debt is repaid, it will give Bayern even more cash to spend on transfers. It is not entirely clear exactly how much more, but former president Uli Hoeness once claimed that they would have an additional €25 million budget each year once the debt had been cleared.

This is symptomatic of Bayern’s refusal to rest on their laurels, even though deputy chairman Dreesen stated, “there is no doubt that Bayern are at a stage they have never been before, both on a sporting level and financially.” Indeed, they are already planning to “go global”, particularly in America, where they have set up an office in New York, developed a US website and played a number of pre-season friendlies.

Although past performance is no guarantee of future success, it would appear that Bayern’s financial prospects are every bit as good as their previous achievements – and that’s saying something.

0 comments:

Post a Comment