Given that Queens Park Rangers were relegated from the Premier League, it would be difficult to disagree with co-chairman Tony Fernandes’ assessment that the 2014/15 season was “a very disappointing and challenging one”.

The West London club’s supporters have been put through a torrid time recently, experiencing the dreaded drop from the top flight twice in the last three seasons, sandwiching a (somewhat fortuitous) promotion.

The poor performances have resulted in numerous managerial changes. In fact, when Jimmy Floyd Hasselbaink replaced Chris Ramsey last December, he became the fifth manager that Fernandes has recruited since he bought a majority shareholding in the club in August 2011.

Fernandes had arrived with great fanfare, stating that his “goal was to turn QPR into an established Premier League club.” The club has invested heavily in the playing squad in pursuit of this objective, but it has pretty much squandered its money, only to end up pretty much where it started, i.e. languishing in mid-table in the Championship.

"Hail to the Chief"

Even though they have spent three of the four completed seasons in the Fernandes era in the lucrative Premier League, in that time QPR have somehow managed to accumulate £143 million of losses (£203 million excluding debt write-off), in spite of generating £249 million of revenue. They have frittered away an incredible £285 million on wages and £114 million on player purchases, while the debt surged to a peak of £194 million.

Despite all this expenditure, there is still no new stadium or training ground. Instead, the money has basically gone on a series of ageing, demotivated players that have failed to deliver – and incidentally had negligible resale value.

This has all flown in the face of Fernandes’ original promises of financial prudence and sustainability: “Football needs to change. There are clubs who are spending money that if they were in a real business they could not afford.”

"Running' around"

As if that were not sufficiently incongruous, his comments on Financial Fair Play (FFP) have also come back to haunt him: “It’s ironic for me that I’m being hammered for wages, because I’m one of the guys who wants FFP. I am pushing for it. It’s the right thing to do.”

Of course, a spending strategy is not completely unjustified, given that there is usually a strong correlation between the size of the wage bill and success on the pitch, but QPR’s execution of this strategy has evidently been a spectacular failure.

So much so that the club has not only massively under-performed on the pitch, but is also being threatened with a substantial fine being imposed by the Football League if they are found guilty of breaking Financial Fair Play (FFP) rules in the 2013/14 Championship promotion season.

"Chery Oh Baby"

However, as ABC once sang, “That was then, this is now.”

There has been a clear change in QPR’s approach since relegation became inevitable with a focus on placing the club on a more secure financial footing. In particular, the club has introduced a more sensible wage structure with a weekly ceiling of £20,000. Crucially, players now have relegation clauses in their contracts, unlike the last time QPR were relegated.

Moreover, the club trimmed the wage bill last summer by offloading high earners, including Joey Barton, Bobby Zamora, Richard Dunne, Rio Ferdinand, Shaun Wright-Phillips, and Adel Taarabt. Similarly, loan players Niko Krancjar, Eduardo Vargas, and Mauricio Isla have all returned to their parent clubs.

As chief executive Lee Hoos observed, “The club is working hard to cut costs across all areas of the business in order to operate in a more sustainable fashion.” He added, “This includes how we act regarding player acquisitions. We are now looking to sign young, hungry players, and in doing so return the club to its roots.”

"Do you come from a land down under?"

This was reinforced by Fernandes, “No more cheque book”, which has effectively meant that QPR now look in the lower leagues for value purchases. It also requires a change in the way that the club has dealt with agents, so that they do not get ripped off, as has been the case in the past.

This was explained by Director of Football (and club legend), Les Ferdinand: “For a few years, agents have been used to dealing with executives at this club, but they’re now dealing with someone who knows a little bit about football.”

In fairness to the owners, they have pumped vast sums of money into the club. In the past few months they converted £181 million of debt into capital, which took the amount of debt they have effectively written-off to £246 million, i.e. near enough a quarter of a billion.

This money has been largely spent on covering QPR’s losses, most recently seen in the 2014/15 figures, where the loss increased from £10 million to £36 million, despite revenue more than doubling from £39 million to a record £86 million following promotion to the Premier League.

Broadcasting revenue rose £38 million (135%) from £28 million to £66 million, thanks to the Premier League TV deal, while there were also significant increases in the other revenue streams: commercial up £7 million (137%) from £5 million to £12 million; gate receipts up £2 million (44%) from £6 million to £8 million.

However, this improvement was completely offset, as there was no repeat of last year’s £60 million exceptional credit for the write-off of some of the shareholder debt.

Surprisingly, the wage bill was actually lower in the Premier League than the Championship, falling by £2 million (3%) from £75 million to £73 million. This somewhat puzzling phenomenon is known to economists as the “Harry Redknapp effect”.

In contrast, other expenses surged by £20 million (186%) from £11 million to £31 million. This sizeable increase was not explained in the accounts, but one factor might be severance payments and pay-offs to departing players. To reinforce this theory, player impairment, i.e. writing-down the value of players, cost the club £12 million in 2014/15.

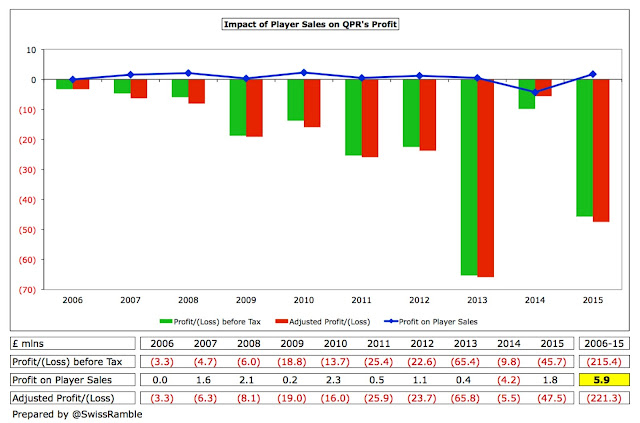

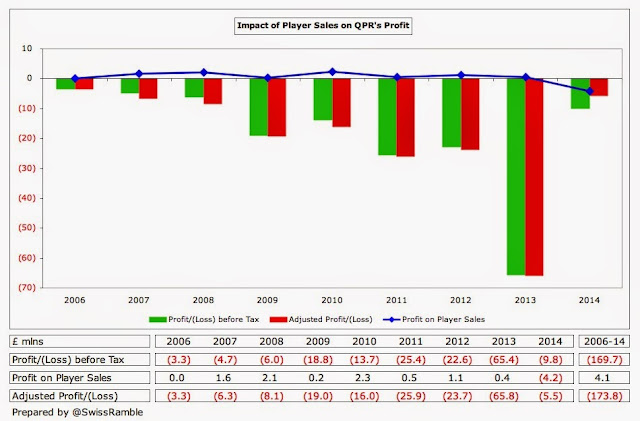

On the other hand, profits on player sales were £6 million higher, though this only brought in £2 million, as the club actually made a £4 million loss from this activity the previous season.

QPR’s £46 million loss was by far the largest reported in the Premier League for 2014/15, comfortably ahead of Aston Villa’s £28 million and Chelsea’s £23 million. In years gone by, this would not have raised eyebrows so much, as traditionally most football clubs lost money, but the increasing TV deals allied with Financial Fair Play (FFP) mean that the Premier League these days is a largely profitable environment.

In fact, 14 clubs reported profits in 2014/15 with just six clubs losing money and two of those (Manchester United and Everton) only lost £4 million. It really was some kind of a special “achievement” for QPR to lose so much money in today’s Premier League.

One highly relevant comparison for QPR would be Burnley, given that the Clarets also gained promotion in 2013/14, only to be immediately relegated the following season. In contrast to QPR’s £46 million loss, Burnley produced a £35 million profit, i.e. just the £81 million better than the Hoops.

This sort of financial performance is nothing new for QPR, as they have posted the largest loss in their division in four of the last five seasons. Remarkably, in 2013/14 their £70 million loss (excluding the debt write-off) was more than three times the loss of any other Championship club except Blackburn Rovers.

Even more notable, in 2012/13 not only was QPR’s £65 million deficit the highest in the Premier League, but their (reported) loss that season has only ever been surpassed in English football by Manchester City and Chelsea, which underlines just how big it really was. Similarly, QPR’s £25 million loss in the 2010/11 promotion season was also the highest in the Championship.

In the last eight seasons QPR have reported aggregate losses of £207 million, but this rises to £274 million if exceptional debt write-offs of £66 million are taken into consideration. Financially this is a real tale of woe, but it’s the Fernandes era that has really set the cat among the pigeons with the club making total losses of £203 million in that period alone (excluding the fancy footwork in the accounts).

That would mean that QPR have lost more money than any other English club in the last four years, even ahead of big-spending Manchester City £163 million and that other well-known financial basket case Aston Villa £101 million.

Fernandes justified this thus, “The financial results reflect the club’s focus on trying to achieve on-pitch success”, but there’s a big difference between “trying” and “achieving”.

Profit from player sales can have a major influence on a football club’s bottom line, as best shown in 2014/15 by Liverpool, whose numbers were boosted by £56 million from this activity, largely due to the sale of Luis Suarez to Barcelona.

However, QPR reported less than £2 million here, even though they made some reasonable sales, e.g. Loic Remy to Chelsea for £10.5 million, Jordon Mutch to Crystal Palace for £6 million, Esteban Granero to Real Sociedad for £4 million and Danny Simpson to Leicester City for £2 million.

Profit from player sales is obviously not as much as the sales proceeds, because any remaining value in the accounts has to be deducted, but the low figures in the accounts imply that other players left at a loss.

Many clubs that run at an operating loss try to reduce the shortfall through player sales, but QPR have made virtually no money from this activity: less than £6 million in the past decade.

Year after the year the accounts include a lengthy list of players that have been released for no money, either retiring, leaving by mutual consent or departing when their contracts expired, which is a pretty good sign that the club has made some terrible purchases.

It should be different in the 2015/16 accounts, as they will benefit from the 20% sell-on fee for Raheem Sterling, which is reportedly worth £8.8 million following the winger’s transfer from Liverpool to Manchester City. Next season’s books will also include the sales of Charlie Austin to Southampton and Alex McCarthy to Crystal Palace.

To get an idea of underlying profitability, football clubs often look at EBITDA (Earnings Before Interest, Depreciation and Amortisation), as this strips out player trading and non-cash items. In QPR’s case, this has been consistently negative, though it did at least improve from minus £47 million to minus £18 million in 2015.

Nevertheless, QPR’s EBITDA was the lowest of all the Premier League clubs in 2014/15 – and the only one that was negative. To place it into perspective, Manchester United’s EBITDA is a mighty £120 million, as an example of a club that is in a genuinely strong cash position. In fact, only two other Premier League clubs did not manage to generate double-digit EBITDA, namely Aston Villa and Swansea City.

What makes QPR’s financial performance so disappointing is that they have spent three of the last four seasons in the Premier League, thus benefiting from the TV deal, either directly in the top flight or via a £24 million parachute payment in 2013/14, and generating around a quarter of a billion of revenue in this period.

This is a far cry from the preceding years in the Championship when revenue was stuck in a range of £14-16 million. Of course, relegation does have a significant impact on revenue, not just broadcasting income, but also leads to reductions in gate receipts and commercial income. This was seen in 2013/14 when revenue fell by 36% (£22 million) from £61 million to £39 million.

Even after their considerable revenue growth in 2015, QPR’s £86 million was still among the lowest in the Premier League, only ahead of Hull City £84 million and Burnley £79 million. From that perspective, perhaps their relegation should not have come as a great surprise, as it is very difficult to compete with others who have more spending capacity.

Just look at the financial might of the elite clubs, who earned at least £200 million more than QPR: Manchester United £395 million, Manchester City £352 million, Arsenal £329 million, Chelsea £314 million and Liverpool £298 million.

Clearly, this season Leicester have shown that money is not the sole indicator of success, but even their revenue was £18 million more than QPR last season. Moreover, it is no coincidence that the three relegated clubs in 2014/15 were those with the lowest revenue.

The vast majority (77%) of QPR’s revenue in the Premier League came from television with just 14% from commercial income and 9% from match day. It was similar in in the Championship, though broadcasting “only” accounted for 72%, (inflated by parachute payments) followed by match day 15% and commercial 13%.

In fairness, this reliance on TV money is fairly common in the Premier League with half the clubs in the top flight dependent on broadcasting for more than 70% of their revenue. That said, this revenue is derived from the central deal and QPR have admitted that they do “not have any influence on the outcome of the relevant contract negotiations.”

In 2014/15 QPR’s share of the Premier League TV money was £64.9 million, compared to £26.0 million in the Championship (£24.1 million parachute payment plus £1.9 million from the Football League pool). Note: if a club receives parachute payments, then it does not also get the £2.3 million solidarity payment from the Premier League that other Championship clubs have.

The distribution of Premier League funds is based on a highly equitable methodology, so the top club (Chelsea) received £99 million compared to the bottom club (QPR) getting £65 million, a ratio of around 1.5.

Most of the money is allocated equally to each club, which means 50% of the domestic rights, 100% of the overseas rights and 100% of the commercial revenue. However, merit payments (25% of domestic rights) are worth £1.2 million per place in the league table and facility fees (25% of domestic rights) depend on how many times each club is broadcast live.

In this way, QPR’s TV money was adversely impacted by not only finishing in the relegation zone, but also only being shown live just 11 times, just one more than the contractual minimum.

The blockbuster new TV deal starting in 2016/17 only reinforces the benefits of promotion to the Premier League. My estimates suggest that QPR would receive an additional £28 million under the new contract, if they finished in the same place as 2014/15, increasing the total received to an incredible £92 million, though even that might be conservative, given the size of the overseas deals announced.

Clearly, this works both ways, so QPR’s 2015/16 revenue in the Championship will be much smaller, falling by an estimated £38 million from £65 million to £27 million, even though the first year parachute payment is now worth £25 million. Obviously, this is still considerably higher than those Championship clubs without parachute payments, who receive only £5 million.

This huge difference in revenue doesn’t quite excuse QPR’s profligacy, but it does explain it to a certain extent. As Fernandes has explained in the past, “A critical driver of any club’s value is its presence in the Premier League.”

Another point worth noting is that from 2016/17 clubs will only receive parachute payments for three seasons after relegation, although the amounts will be higher. My estimate is £75 million, based on the percentages advised by the Premier League (year 1 – £35 million, year 2 – £28 million and year 3 – £11 million). Up to now, these have been worth £65 million over four years: year 1 – £25 million, year 2 – £20 million and £10 million in each of years 3 and 4.

Even with the benefit of parachute payments, it’s still a considerable reduction in revenue for QPR, which has necessitated major cuts in the cost base. Of the three clubs relegated the previous season, Fulham is probably the closest comparative to Rangers and their revenue fell by £49 million, with a consequent £32 million cut in the wage bill.

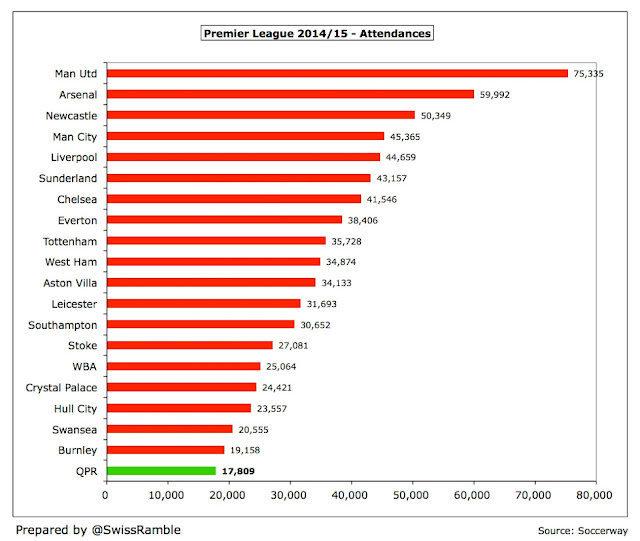

QPR’s match day revenue rose by £2.5 million (44%) from £5.6 million to £8.1 million in 2014/15 as ticket pricing was increased to reflect that they were playing in the Premier League (though this was held to the 2012/13 levels from the previous time they were in the top flight).

This was one of the lowest in the division, only ahead of WBA, Swansea City, Stoke City (all around the same £8 million level) and Burnley £6 million. Gate receipts will inevitably decrease again in 2015/16, as the prices were frozen from the last time that QPR competed in the second tier of English football.

Fernandes commented, “People always talk about the atmosphere at Loftus Road – we want to make sure our fans can afford to come to the games to help create that.” That’s an admirable approach, but QPR’s ticket prices are still among the highest in the Championship.

The 2014/15 match day revenue was also boosted by QPR’s average attendance rising by 1,153 from 16,656 to 17,809 (including more than 10,000 season ticket holders), though they obviously hosted fewer home games in the Premier League than the Championship.

As might be expected, QPR’s attendances are higher when they compete in the Premier League, but they still had the smallest crowds in the top flight. To place this into context, their attendance was around 1,300 lower than Burnley, their fellow relegated team, despite the club’s claim that they are “confident that our pricing structure will help to encourage fans to attend.”

Part of the problem is the very low 18,489 capacity at Loftus Road, which is far from ideal for a club with aspirations of competing at the top level. It is therefore no surprise that the club has been looking to move to a new 40,000 seat stadium with the Old Oak Common site in north-west London being identified.

There has been some talk about the club moving there for the 2018/19 season, but this is nowhere near a fait accompli, as there is strong opposition from the site owner, Car Giant, coincidentally a former QPR sponsor, who stated that they had no plans for a football stadium in their development.

There is also the small matter of how the club would finance a new stadium. Interestingly, the accounts include £10 million spent on Rangers Developments Limited in the last two years in the note on Related Party Transactions, though this is not further explained.

Furthermore, chief executive Hoos has implied that the club’s focus is more on the new training ground at Warren Farm: “Kevin Keegan once said if you have to choose between the stadium and the training ground for an investment – do the training ground. The stadium is once a fortnight, but the training ground is every day for players where we can train and develop young players. We’ve got to have it.”

QPR’s commercial income surged following promotion, more than doubling from £5.0 million to £11.8 million, comprising sponsorship and advertising £5.1 million, commercial income £4.3 million and other income £2.5 million. This is maybe not that big a surprise, given that the club had previously stated that it “believes that its Premier League status will help it to significantly increase its commercial revenue.”

Nevertheless, it was still one of the lowest in the Premier League, only ahead of Southampton, WBA, Swansea City, Burnley and Hull City. To put this into context, commercial giants like Manchester United and Manchester City earned £197 million and £173 million respectively, though, to be fair, only the elite English clubs can expect to earn vast sums commercially.

QPR’s shirt sponsorship deal with Tony Fernandes’ airline AirAsia was extended in 2014/15 season and was worth £2.5 million in the Premier League, comparing favourably with clubs like West Ham and Stoke City, though obviously miles behind the deals for Manchester United, Arsenal, Liverpool, Manchester City and Chelsea.

The club will have a new kit supplier at the end of the current season, as Canadian brand DRYWORLD will replace Nike in a 10-year deal. Although the commercial director was keen to emphasise that the priority for this deal was “complete autonomy” over the kits, it does seem strange to commit for so long with no scope for securing a better offer if QPR do manager to gain promotion.

What has really damaged QPR’s finances is their unbelievable wage bill with the club shelling out £285 million in the four years under Fernandes. On the plus side, wages actually fell by £2 million (3%) from £75 million to £73 million in 2014/15, but that only underlined how ridiculous the wage bill was in the Championship.

In the last four seasons the wage bill has risen by £43 million (145%), while headcount has exploded from 114 to 163, including a 34 increase in the number of players, managers and coaches from 74 to 108.

Although the wages to turnover ratio improved from a completely unsustainable 195% in the Championship to 85%, this was still the worst in the Premier League, miles higher than the next club, WBA 73%.

In fact, QPR’s wage bill was the 9th highest in the Premier League, which was out of all proportion to their revenue (and indeed their performances on the pitch). It might be argued that relegation was quite likely for Hull City and Burnley, given their low wage bills (£56 million and £29 million respectively), but QPR have punched well below their weight here.

It was even worse in the Championship in 2013/14, when QPR’s wage bill of £75 million was at least twice as much as every other club in the division. The other clubs to achieve promotion that season managed this on significantly lower wage bills: Leicester City £36 million and Burnley £15 million.

The good news is that the club appears to have learnt its lesson from the last time they went down, as confirmed by Fernandes: “Apart from the legacy players – and most of their contracts have finished – every player has relegation clauses.”

Hoos has confirmed that the wage bill is under review: “Player payroll is the single biggest expense that we have by a long, long shot. Part of my job coming in here was to rationalise the pay bill. It’s simply trying to get the most bang for your buck.”

This will be facilitated by a number of players seeing their contracts come to an end this summer, including Junior Hoilett, Alejandro Faurlin, Armand Traore, Karl Henry, Samba Diakite, Rob Green, Paul Konchesky and Clint Hill.

Other expenses are also very high at QPR. Excluding wages, player amortisation, impairment and depreciation, these increased by £20 million to £31 million, which was the 7th highest in the Premier League in 2014/15.

One factor here is the stadium operating costs, as Hoos explained: “There are huge costs in terms of stewarding and police, because of two tiers. Most stadiums of this capacity are single tier. It’s double here than what you might expect and makes it a real inefficient operation to run.”

Another cost that has hurt QPR’s numbers is player amortisation, which has risen from £3 million in 2011 to £16 million in 2015, reflecting the high expenditure on player purchases. As a reminder, when a club buys a player, it does not show the full transfer fee in the accounts in that year, but writes-down the cost (evenly) over the length of the player’s contract via player amortisation.

To illustrate how this works, if QPR were to pay £10 million for a new player with a five-year contract, the annual expense would only be £2 million (£10 million divided by 5 years) in player amortisation (on top of wages).

However, QPR’s player amortisation of £16 million was still among the lowest in the Premier League, just behind Swansea City. To place this into perspective, player amortisation at a really big spender like Manchester United is around six times as much, with the massive outlay under Moyes and van Gaal driving their annual expense up to £100 million.

In the first four years of Fernandes’ reign (2011-15), the club “made a significant investment in relation to bringing new players to QPR”, amounting to gross spend of £105 million, net spend of £68 million. There is no doubt that the board has provided substantial financial backing to its various managers, though ironically one of them, a certain Harry Redknapp, repaid this generosity by accusing the owners of “having their pants taken down”.

There has been a distinct transformation this season with QPR more than covering the £12 million cost of their purchases with sales of £16 million, leading to net sales of £4 million. The highest amount paid for a player was £2.5 million to Peterborough United for Conor Washington, while there have been some astute signings like the Swindon duo, Massimo Luongo and Ben Gladwin, and others have arrived on free transfers, e.g. Jamie Mackie and Jay-Emmanuel Thomas.

In fact, QPR’s net spend/sales were only the 15th highest in the Championship in 2015/16, which is distinctly different from previous campaigns. It is also a long way behind those clubs who are still gambling on spending their way out of the division, e.g. Derby County £26 million, Middlesbrough £17 million and Sheffield Wednesday £11 million.

Recently the FA released a list of agent fees, which showed that QPR paid the most to agents in the Championship for the period October 2015 to February 2016. At first glance, this seems to suggest that QPR have not changed s much as advertised, but this was explained by Sir Les: “It is important everyone understands that historical transfers are responsible for a large proportion of our current payments.”

All of this spending has been built on a mountain of debt, which rose from £14 million in 2006 to £194 million in 2014. That is pretty shocking given that the club has spent three years in the Premier League in that time.

Incredibly, the figure would have been even higher at £260 million if the shareholders had not written-off £60 million and converted £5 million into equity (the maximum permitted by FFP rules) in 2014.

The good news is that a further £181 million of the outstanding shareholder loans was converted into capital subsequent to the year-end, so the current debt is substantially lower.

At the balance sheet date, most of the debt (£173 million) was owed to the club’s owners, comprising £130 million to QPR Asia Sdn Bhd (a company controlled by Fernandes), £33 million to Sea Dream Limited (a company owned by the Mittal family) and £10 million to Amulaya Property Limited (a company entirely owned by Tune QPR and Sea Dream). This is non-interest bearing.

However, the club has also taken on £21 million of bank loans, secured on the Loftus Road Stadium, which charges interest at 3.5% plus LIBOR, resulting in a £1 million payment in 2015. This is due to be repaid in a year, though could be rescheduled.

In addition, net transfer debt increased from £1 million to £21 million in 2015.

Before the debt conversion, only two Premier League clubs had more debt than QPR: Manchester United, who still have £444 million of borrowings even after all the Glazers’ various re-financings; and Arsenal, whose £232 million debt effectively comprises the “mortgage” on the Emirates stadium.

As we have seen, QPR have consistently reported operating losses, even after excluding non-cash items like player amortisation, impairment and depreciation. In 2014/15 they actually generated £12 million of cash from operating activities, but that was largely down to working capital movements, especially a £23 million increase in creditors. Despite this, they still ended up with a net cash outflow, mainly due to net payments on player acquisition.

In the Fernandes era, the club has had £205 million cash available to spend, but all of this has come from increasing debt: £184 million from the owners and £21 million from the bank. Around half of this (£107 million) was spent covering operating losses with a further 40% (£84 million) on player purchases (net).

Strikingly, only a feeble £8 million (4%) has been spent on infrastructure investment in the last four years, despite all the fine talk of a new stadium and a new training complex.

To add insult to injury, QPR are still facing the threat of a hefty Financial Fair Play fine from the Football League, who have queried the “treatment of certain items in their accounts”, namely the £60 million debt write-off in 2013/14.

Under the rules prevailing at the time, clubs were only allowed a maximum annual loss of £8 million (assuming that any losses in excess of £3 million were covered by injecting equity). Any clubs that exceeded those losses were subject to a fine (if promoted) or a transfer embargo (if they remain in the Championship).

If the £60 million debt write-off is not allowed, that would imply an enormous fine of £58 million, though it has been suggested that deducting allowable expenditure like youth development and promotion bonuses would reduce that to £43 million. Either way it’s a huge amount of money.

"White car in Germany"

However, QPR have challenged the legality of these rules. Their defence might include a number of factors, especially the fact that the Football League has already modified the rules that were applicable in 2013/14, while UEFA have also recently relaxed their version of FFP.

As is usually the case, Fernandes is expecting a favourable outcome: “I’ve always been very confident that a positive resolution will come out of the FFP case that is fair to everyone.” His view was reiterated in the recent accounts: “The directors are of the opinion that the claim by the Football League can be successfully resisted.”

Other Championship clubs would obviously be unhappy if QPR “got away with it”, especially those that have strived to stay within the rules, or those like Nottingham Forest and Blackburn Rovers, who were both subject to a transfer embargo for their own breaches of FFP rules. That said, it would not be a major shock if some form of compromise settlement on a lower sum were to be agreed – with a figure of £8 million being bandied about.

In many ways, QPR are fortunate to have Fernandes, who cannot be accused of under-funding the “project”, but for a long time he gave the impression of being one of those successful businessmen that seem to forget the strategies that have worked so well in their day job once they enter the world of football.

"Jesse James Symphony"

Despite the best of intentions and a massive amount of money spent, it is arguable that the club has not made any progress at all since Fernandes turned up in 2011. However, there does appear to be a new mood at Loftus Road, one where the board has finally appreciated that they need to operate in a far smarter manner. As the late, very great Prince once sang, “All that glitters ain’t gold.”

Certainly, Jimmy Floyd Hasselbaink is optimistic about the future: “I feel that this is a club on the up – it has an exciting feeling about it.”

That might be dismissed as exactly the sort of thing that a new manager would say, but in a way it was more encouraging to see Fernandes’ restrained New Year message to fans: “Undoubtedly there will be ups and downs along the way in an effort to get the long-term right, but with your unwavering support, we can achieve our goals of building a competitive squad and being a competitive club.”

Not the most thrilling of manifestos perhaps, but it is imperative that QPR put the right foundations in place for a stable football club, because their previous, somewhat chaotic approach has plainly not worked. It has only succeeded in wasting a lot of money, so the move towards a more sensible strategy is not before time.