In my last post, I valued Spotify, using information from its prospectus, and promised to come back to cover three loose ends: (1) a pricing of the company to contrast with my intrinsic valuation, (2) a valuation of a Spotify subscriber and, by extension, a subscriber-based valuation of the company, and (3) the value of big data, seen through the prism of what Spotify can learn about its subscribers from their use of its service, and convert to profits.

1. The Pricing of Spotify

I won't bore you by going through the full details of the contrast that I see between pricing an asset and valuing it, since it has been at the heart of so many of my prior posts (like this, this and this). In short, the value of an asset is determined by its expected cash flows and the risk in these cash flows, which you can estimate imprecisely using a discounted cash flow model. The price of an asset is based on what others are paying for similar assets, requiring judgments on what comprises similar. My last post reflected my attempt to attach an intrinsic value to Spotify, but the pricing questions for Spotify are two fold: the companies that investors in the market will compare it to, to make a pricing judgment, and the metric that they will base the pricing on.

Let's start with the simplest version of pricing, a one-on-one comparison. With Spotify, the two companies that are likeliest to be offered as comparable firms are Pandora, a company that is in the same business (music streaming) as Spotify, deriving its revenues from advertising and subscription, and Netflix, a company that is also subscription-driven, and one that Spotify would like to emulate in terms of market success. Since Spotify and Pandora are reporting operating losses, there are only three metrics that you can scale the pricing of these companies to: the number of subscribers, total revenues and gross profits. I report the numbers for all three companies in the table below, in conjunction with the enterprise values for Pandora and Netflix:

For Pandora and Netflix, the numbers for users and revenues/profits come from their most recent annual reports for the year ending December 31, 2017, and for Spotify, the numbers are from the prospectus covering the same year. To use the numbers to price Spotify, I first estimate pricing multiples for Pandora and Netflix. and then use these multiples on Spotify's metrics:

To illustrate the process, I price Spotify, relative to Pandora and based on subscribers, by first computing the enterprise value/subscriber for Pandora (EV/Subscriber= 1135/74.70 = 15.19). I then multiply this value by Pandora's total subscriber count of 159 million to arrive at a pricing of $2,416 million for Spotify. I repeat this process for Netflix, and then repeat it again with both companies, using revenues and gross profit as my scaling variables. The table of pricing estimates that I get for Spotify explains why those who are bullish on the company will try to avoid comparisons to Pandora and encourage comparisons to Netflix. If, as is rumored, Spotify's equity is priced at between $20 and $25 billion, it will look massively over priced, if compared to Pandora, but be a bargain, relative to Netflix. As you can see, each of these comparisons has problems. Spotify not only has a more subscription-based revenue model than Pandora, yielding higher overall revenues, but its more global presence (than Pandora) has insulated it better from competition from Apple Music. Netflix has an entirely subscription-based model and generates more revenues per subscriber, while facing less intense competition. The bottom line is that the pricing range for Spotify is wide, because it depends on the company you compare it to, and the metric you base the pricing on. That may come as no surprise for you, but it will explain why there will wide divergences in pricing opinion when the stock first starts to trade, resulting in wild price swings. If you are not adept at the pricing game, and I am not, you should stay with your value judgment, flawed though it might be. I will consequently stick with my intrinsic value estimate for the equity in the company.

2. A Subscriber-Based Valuation of Spotify

Last year, I did a user-based valuation of Uber and used it to understand the dynamics that determine user value and then to value Amazon Prime. That framework can be easily adapted to value Spotify subscribers, both existing and new. To value Spotify's existing subscribers, I started with the base revenue per subscriber and content costs in 2017, made assumptions about growth in each item and used a renewal rate of 94.5%, based again upon 2017 numbers (all in US dollar terms):

|

| Download spreadsheet |

Note that revenues/subscriber grow at 3% a year, faster than the growth rate of 1.5%/year in content costs, reducing content costs to 70% of subscriber revenues in year 10, consistent with the assumption I made in the top down valuation in the last post. The value of a premium subscriber, allowing for the churn in subscriptions (only 43% make it through 15 years) and reduced content costs, is $108.65, and the total value of the 71 million premium subscriptions works out to about $7.7 billion.

To estimate the value of new users, I first had to estimate how much Spotify was spending to acquire a new user. To obtain this value, I took the total marketing costs in 2017 (567 million Euros or $700 million) and divided that by the number of new subscribers added in 2017:

Cost of acquiring new user = 700 / (71 - 48*.945) = $27.30

While the number of premium subscribers grew from 48 million to 71 million, I reduced the former value by the churn reported (5.5% of subscribers canceled in 2017). The value of new subscribers then can be computed, assuming that the number of net subscribers grows 25% a year from years 1-5, 10% a year from years 6-10 and 1% a year thereafter (The weakest link in this calculation is the churn rate, which as some of you pointed out is measured in monthly terms. I read this section of the prospectus multiple times to get a better sense of renewal and cancellation rates and here is what I get out of that reading. If the true monthly churn rate is 5.5%, the annual churn rate should more than 50%, meaning that 25 million of the 48 million subscribers that Spotify had at the start of the year left during the year. I don't think that happened, because the total subscribers would not have jumped to 71 million. My guess is that the monthly churn rate reflects how new subscribers become established subscribers, with many trying the service for a month, dropping it, and then coming back again. The annualized churn rate is probably closer to 15%-20% overall and much lower for established Spotify subscribers. I considered using a lower renewal rate in the early years and increasing it in later years, but gave up on it since my information is still hazy. I do believe that will be a key factor in whether Spotify can deliver value, and while the trend lines on the churn rate are good, they need to make their subscribers as sticky as Netflix has made its subscribers.)

While the number of premium subscribers grew from 48 million to 71 million, I reduced the former value by the churn reported (5.5% of subscribers canceled in 2017). The value of new subscribers then can be computed, assuming that the number of net subscribers grows 25% a year from years 1-5, 10% a year from years 6-10 and 1% a year thereafter (The weakest link in this calculation is the churn rate, which as some of you pointed out is measured in monthly terms. I read this section of the prospectus multiple times to get a better sense of renewal and cancellation rates and here is what I get out of that reading. If the true monthly churn rate is 5.5%, the annual churn rate should more than 50%, meaning that 25 million of the 48 million subscribers that Spotify had at the start of the year left during the year. I don't think that happened, because the total subscribers would not have jumped to 71 million. My guess is that the monthly churn rate reflects how new subscribers become established subscribers, with many trying the service for a month, dropping it, and then coming back again. The annualized churn rate is probably closer to 15%-20% overall and much lower for established Spotify subscribers. I considered using a lower renewal rate in the early years and increasing it in later years, but gave up on it since my information is still hazy. I do believe that will be a key factor in whether Spotify can deliver value, and while the trend lines on the churn rate are good, they need to make their subscribers as sticky as Netflix has made its subscribers.)

|

| Download spreadsheet |

In valuing the cash flows from new users, I use a 10% US$ cost of capital, the 75th percentile of global companies, reflecting the higher risk in this component of Spotify's value, and derive a value of about $13.6 billion for new users. (I thank the readers who noticed that I was misestimating my subscriber count, starting in year 2. The numbers should now gel, with the growth rate in net subscribers matching up.)

Spotify does get about 10% of its revenues from advertising, and I will assume that this component of revenue will persist, albeit growing at a lower rate than premium subscription revenues; the revenues will grow 10% a year for the next ten year and content costs attributable to these revenues will also show the same downward trend that they do with premium subscriptions. The value of the advertising revenues is shown to be about $2.9 billion:

Spotify does get about 10% of its revenues from advertising, and I will assume that this component of revenue will persist, albeit growing at a lower rate than premium subscription revenues; the revenues will grow 10% a year for the next ten year and content costs attributable to these revenues will also show the same downward trend that they do with premium subscriptions. The value of the advertising revenues is shown to be about $2.9 billion:

|

| Download spreadsheet |

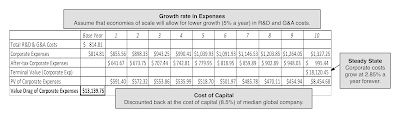

The final component of value is mopping up for costs not captured in the pieces above. Specifically, Spotify has R&D and G&A costs that amounted to 660 million Euros in 2017 (about $815 million), which we assume will grow 5% a year for the next 10 years, well below the growth rate of revenues and operating income, reflecting economies of scale. Allowing for the tax savings, and discounting at the median cost of capital (8.5%) for a global company, I derive a value for this cost drag:

|

| Download spreadsheet |

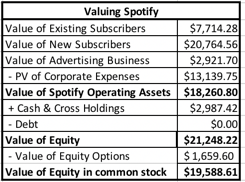

The value for Spotify, on a user-based valuation, can then be calculated, adding in the cash balance (1,5091.81 million Euros or $1,864 million) and a cross holding in Tencent Music that I had overlooked in my DCF (valued at 910 million Euros or $1,123 million), and netting out the equity options outstanding (valued at 1344 million Euros or $1660 million):

|

| Download spreadsheet |

3. The Big Data Premium?

There is one final component to Spotify's value that I have drawn on only implicitly in my valuations and that is its access to subscriber data. As Spotify adds to its subscriber lists, it is also collecting information on subscriber tastes in music and perhaps even on other dimensions. In an age where big data is often used as a rationale for adding premiums to values across the board, Spotify meets the requirements for a big data payoff, listed in this post from a while back. It has exclusivity at least on the information it collects from its subscribers on their musical tastes & preferences and it can adapt its products and services to take advantage of this knowledge, perhaps in helping artists create new content and customizing its offerings. That said, I do no feel the urge to add a premium to my estimated value for three reasons:

- It is counted in the valuations already: In both my top down and user-based valuations, I allow Spotify to grow revenues well beyond what the current music market would support and lower content costs as they do so. That combination, I argued, is a direct result of their data advantages, and adding a premium to my estimated valued seems like double counting.

- Decreasing Marginal Benefits: The big data argument, even if based on exclusivity and adaptive behavior, starts to lose its power as more and more companies exploit it. As Facebook reviews our social media posts and tailors advertising, Amazon uses Prime to get into our shopping carts and Alexa to track us at home, and uses that data to launch new products and services and Netflix keeps track of the movies/TV that we watch, stop watching and would like to watch, there is not as much of us left to discover and exploit.

- Data Backlash: Much as we would like to claim victimhood in this process, we (collectively) have been willing participants in a trade, offering technology companies data about our private lives in return for social networks, free shipping and tailored entertainment. This week, we did see perhaps the beginnings of a reassessment of where this has led us, with the savaging of Facebook in the market.

The big data debate has just begun, and I am not sure how it will end. I personally believe that we are too far gone down this road to go back, but there may be some buyers' remorse that some of us are feeling about having shared too much. If that translates into much stricter regulations on data gathering and a reluctance on our part to share private data, it would be bad news for Spotify, but it would be worse news for Google, Facebook, Netflix and Amazon. Time will tell!

YouTube Video

Data Links

0 comments:

Post a Comment